CHRISTOPHER J. COLLINS

MORTGAGE PROFESSIONAL

Thank you for visiting my website, I’m Christopher Collins, mortgage professional with XEVA mortgage. Having over 20 years of experience as a mortgage broker, I work with my clients to provide the very best solutions based on their individual needs and goals. My focus is to help build you and your families financial future together which doesn't stop at the best rate or lender. I believe success includes long lasting relationships built on results, and trust.

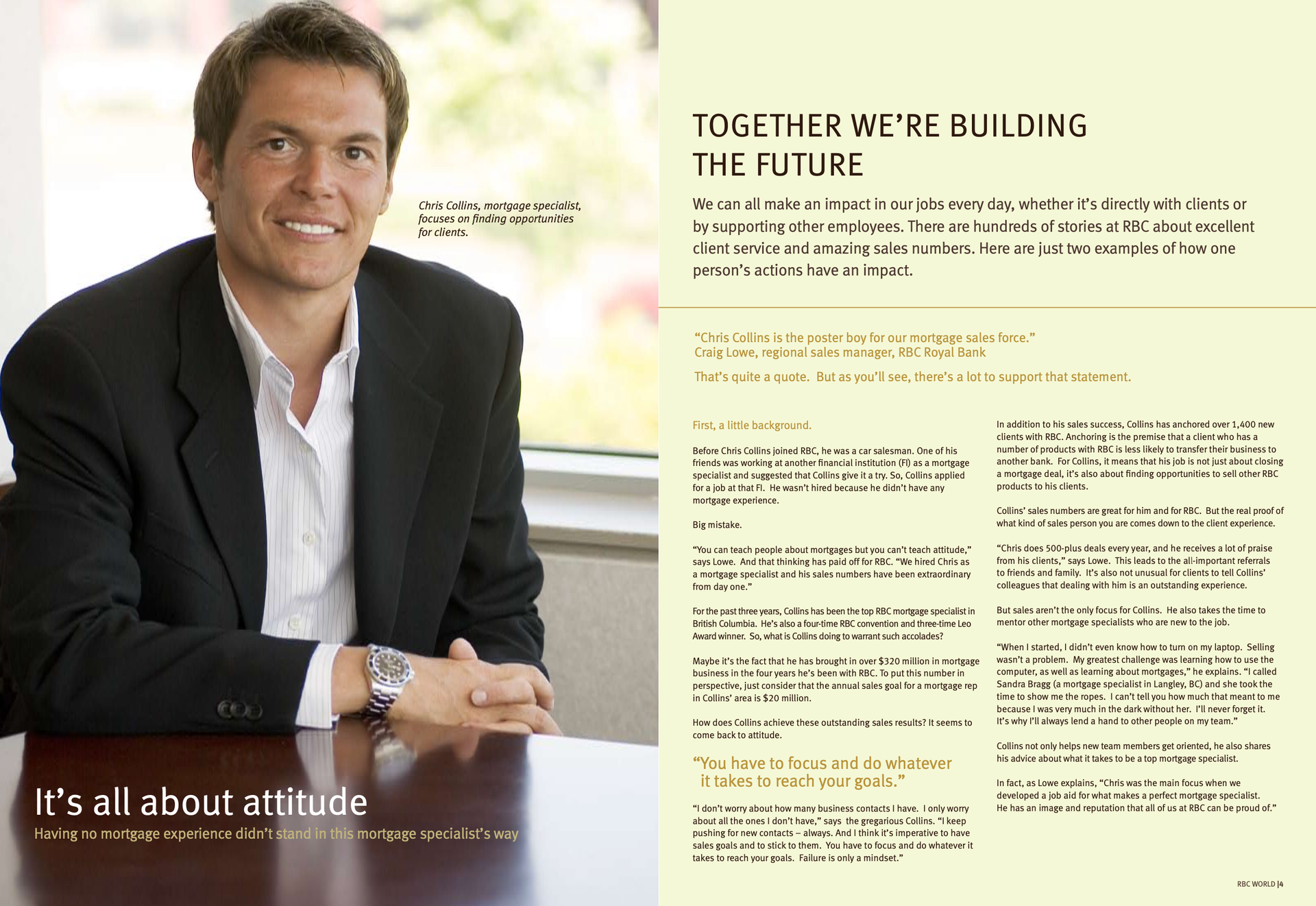

I began my mortgage career in 2000 with RBC-Royal Bank, learning early on the value of people, teamwork and urgency while serving my clients needs, always looking out for the very best products and solutions for their long-term financial success. During my time at RBC, I'm proud to have had the honour of being the #1 mortgage specialist in Canada for several years, being a 4-time recipient of the "LEO Award”, which is RBC’s highest honour. My greatest achievement however has always been building many long-lasting relationships in serving my clients and the honour of their continued referrals.

As your trusted mortgage advisor, I understand that the importance of proper advice while shopping for the right mortgage for you, is critical. When looking to get pre-approved, refinance, renew or switch your existing mortgage, we will guide you through the complexities of our ever-changing mortgage landscape, providing you the very best solution with an exceptional client experience for life!

Partnering with XEVA mortgages, one of the most respected mortgage brokerages in Canada will provide our clients continued access to the very best mortgage options available. We work for you, not the banks.

RBC-Royal Bank LEO Award Winner

Working With Me Is SImple

Get started right away

The best place to start is to connect with me directly. My commitment is to listen to your needs,

assess your financial situation, provide professional mortgage advice, and

guide you through the mortgage process.

Get clarity

Sorting through all the different mortgage lenders, rates, terms, and features can be overwhelming.

Let me cut through the noise. I'll outline the best mortgage products available with your needs in mind.

Proceed with confidence

My goal is to make sure you

know exactly where you stand at all times.

From your initial application through your mortgage renewal, I'm available to answer any questions for as long as you need a mortgage.

I've got you covered.

Nice things people have said about working with me.

SEE WHAT YOU CAN AFFORD

Let's Run Some Numbers.

Get started by completing my online mortgage application.

I'll let you know exactly where you stand so you can proceed with confidence.

Go ahead and schedule a meeting

with me!

Mortgage Services

Know the right mortgage product for your circumstance.

Mortgage articles to keep you informed.